About Governance

The Canadian Baptist Pension Plan (CBPP) was founded by the Federation of Canadian Baptist Churches in the late 1950s and was originally a defined benefit pension plan.

To oversee the governance and maintenance of the CBPP and the Employee Group Benefits and Insurance plan (CBBP), the Board of Directors (BOD) of the Canadian Baptist Ministries (CBM) was established. They work in partnership with the Canadian Baptist family of denominations, churches, and partners.

The BOD acts as the Plan Administrator and Sponsor, and is supported by dedicated staff, an established Audit Committee, and a Pension and Insurance Committee. Together, they effectively govern, manage, and operate the CBPP and CBBP, and assets.

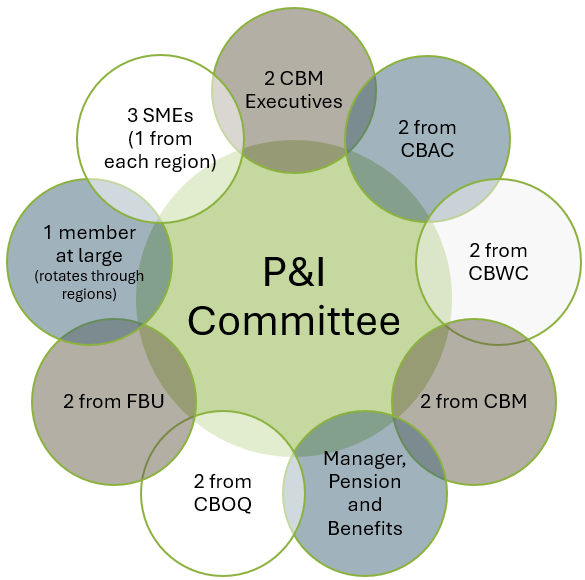

The CBBenefits Pension & Insurance Committee (P&I Committee)

Their mission: to achieve the CBPP and CBBP design, monitoring, and evaluation objectives that will ensure the plans are high quality, cost-effective, and affordable for participating members and employers.

The P&I Committee consists of CBM staff members and representatives of the Conventions and Unions. Bi-annually, the Chairperson is nominated by the subject matter expert (SME) Committee members or by a member at large, and elected by the Committee.

- Each Committee member is expected to actively participate in meetings and offer valuable insights to inform decisions related to Plan activities.

- The Committee aims to meet semi-annually; however, special meetings may be convened as needed to address additional work between regular sessions. Any member may request a special meeting, subject to the approval of the Committee Chairperson.

- The Committee may establish sub-committees as needed, assigned to specific tasks related to the CBPP and/or CBBP.

The P&I Committee’s Responsibilities

While the list below is not exhaustive, the following task list provides some insight into P&I Committee members’ responsibilities:

- Determining appropriate levels of investment risk within the portfolios;

- Monitoring investment managers to optimize investment returns over the long term;

- Administering pension and benefit plans in compliance with regulatory requirements, contractual obligations, and internal policies;

- Providing regular communication to educate employers and plan members on plan provisions, rights, obligations, and the impact of their investment choices;

- Ensuring the accuracy and timeliness of plan administration services to members and employers;

- Evaluating the performance of plan service providers; and

- Regularly reviewing and adjusting the design of benefit plans as needed.

Partners and Service Providers

In carrying out its responsibilities, the P&I Committee may delegate activities to CBM officers, employees, or external service providers.

The P&I Committee will ensure that all delegated parties are properly supervised and possess the skills and training deemed appropriate by the Committee.

Despite such delegation, the Committee retains ultimate responsibility for all delegated tasks.

|  | |

| Eckler Ltd. - Pension Consultants |  | Eckler Ltd. - Group Benefits Consultants |

| Canada Life - Recordkeeper |  | Canada Life - Benefits Administrator |

| Fidelity Investments - Investment Manager |  |